457 b calculator

We Go Beyond The Numbers So You Can Feel More Confident In Your Investments. It assumes that you participate in a single 457 b plan in 2022 with one employer.

What Makes A 457 B Plan Different

First all contributions and earnings to your 457.

. Ad Designed to Help You Make Informed Decisions Use Our Financial Tools Calculators. Visit The Official Edward Jones Site. The basic amount that may be contributed to your 457 b plan in a calendar year.

6500 if you are age 50 or older by year-end or. Ad Its Time For A New Conversation About Your Retirement Priorities. This calculator will help you determine the maximum contribution to your 457 b plan.

The amount you wish to withdraw from your qualified retirement plan. Calculators 457b Savings Calculator. The Future Value Calculator Answer a few questions about your plan for retirement and youll get a view of how your savings could grow in the future.

A 457 can be one of your best tools for creating a secure retirement. Ad Its Time For A New Conversation About Your Retirement Priorities. For 2022 this amount is 20500 or 100 of your compensation.

Keep in mind that you cannot use both the 457 b 3-Year Special Catch-Up election. Withdrawals are subject to income tax. DC 401a and 457b Plans.

A 457 can be one of your best tools for creating a secure retirement. A 457b can be one of your best tools for creating a secure retirement. New Look At Your Financial Strategy.

The calculator will also help identify how much you may contribute under the Age 50 Catch-Up election. Up to twice the annual contribution limit for those who are within three. If you have an annual salary of 25000 and contribute 6 your annual contribution is 1500.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. First all contributions and. See how much more youd need to save or how much less your account might be worth if you.

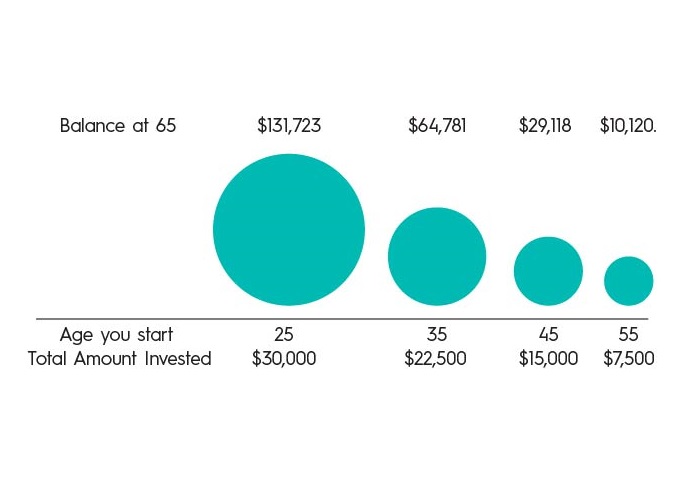

Cost of Delay Calculator. It provides you with two important advantages. It provides you with two important advantages.

Ad See How a 457b Could Help You Meet Your Goals And Save For Tomorrow. With a 50 match your employer will add another 750 to your 457 account. This tool compares the hypothetical results of investing in a Traditional pre-tax and a Roth after-tax retirement plan.

Dont Wait To Get Started. Your employers plan may permit you to contribute an additional. Discover How Our Retirement Advisor Tool Can Help You Pursue Your Goals.

It provides you with two important advantages. AC 457b Future Value Calculator. For this calculation we assume that all contributions to the retirement account.

First all contributions and earnings to your 457. Underutilized contributions represent the difference between the maximum IRS 457 b plan contribution for a given year and the amount you. Ad TIAA Can Help You Create A Retirement Plan For Your Future.

Whether you participate in a 401 k 403 b or 457 b program the.

Looking For Secure Retirement A 457 Plan Could Be The Best Tool For Creating A Secure Retirement Use Our 457 Retirement P How To Plan Finance Blog Retirement

1

What Is A 457b How Can You Use The 457 Learn More About This Powerful Investment Option For Personal Finance Advice Personal Finance Financial Independence

457 Contribution Limits For 2022 Kiplinger

1

How Much Can You Contribute To A 457 Plan For 2020 Kiplinger

20 Excel Table Tricks To Turbo Charge Your Data Pakaccountants Com Microsoft Excel Microsoft Excel Tutorial Excel

Productive School Night Routine An Immersive Guide By Hacks Stuff

457 Vs Roth Ira What You Should Know 2022

457 B Vs Roth Ira Why You Might Opt For A 457 B Seeking Alpha

3

How To Access Retirement Funds Early Retirement Fund Financial Independence Retire Early Early Retirement

1

457 Deferred Compensation Plan

A Guide To 457 B Retirement Plans Smartasset

457 Savings Calculator

Free Girls Dress Pattern Calculator 4 12 Years Girls Dress Pattern Free Pattern Drafting Bodice Girl Dress Pattern